In recent times Outsourced Accounting become much more commercial for businesses to outsource their Accounting and Bookkeeping. As Outsourced Accounting offers multiple benefits, it’s becoming more common for businesses and teams to work remotely. Hiring in-house or outsourcing has a mass impact on your organization’s performance, expenses, and culture. In this article, we will discuss what the outsourced accounting service is, what are the Pros and Cons, and the difference between In-House Hiring VS Outsourcing.

What is Outsourced Accounting?

Outsourced accounting is when a company/business hires a third party to accomplish the organization’s accounting function and finance function which is outside of their company. An outsourced accountant handles all the business’s finance functions, including; payroll, financial reports, bookkeeping, tax, accounts payable, management accounting, following up debtors, accounts receivable, and other accounts-related services.

In several cases, outsourcing is called subcontracting. In a wider sense, Outsourced bookkeeping is sometimes called Business Process Outsourcing (BPO), which means that an external company provides all of a business function or part of business functions. The more specific term used is Finance and Accounting Outsourcing (FAO).

Why Should You Outsource Accounting Services?

Being a manager or business owner for your company can sometimes imply that you are the one taking care of everything. Being responsible and reliable for your company’s success and making sure everything happens according to your indications, is a tough job. But there is one area, that should be the same for all the businesses and companies, something that can be done without any creative input, which is Accounting.

Financing, Budgeting, data analysis, and compliance can make or break your business, especially for a new startup. Mistakes in paying taxes or tracking cash flow can be disastrous to your business and should not be left to chance.

When it comes to the financing function of your business, there are several options to consider: You can either hire an internal accountant or bookkeeper to handle daily work or outsource your accounting and bookkeeping to a professional certified public accounting firm, (CPA) firm.

Pros of Hiring In-House Vs Outsourcing

Hiring in-house and outsourcing, both have many benefits that aid in various business needs and functions. Below are some of the most valuable pros of each hiring option.

Pros of Hiring In-House

- It’s convenient and easier for in-house employees to cooperate during strategic projects that require extra input from people within your organization.

- Employees quickly learn and adapt your company’s culture which helps them understand your business model, also reduces miscommunications and errors. Your employees may also be more accepting as compared to contractors.

- In-house employees can work extra hours according to company needs. Most in-house employees accept that they will sometimes need to work late to assist their team. Whereas contractors, are paid for a fixed number of hours and you need to make plans in advance to let them work extra.

- You have full control over the In-house employees who you work with. The hiring of personnel lets you find someone with all the technical skills you want plus a personality that best fits with your team.

Pros of Outsourcing

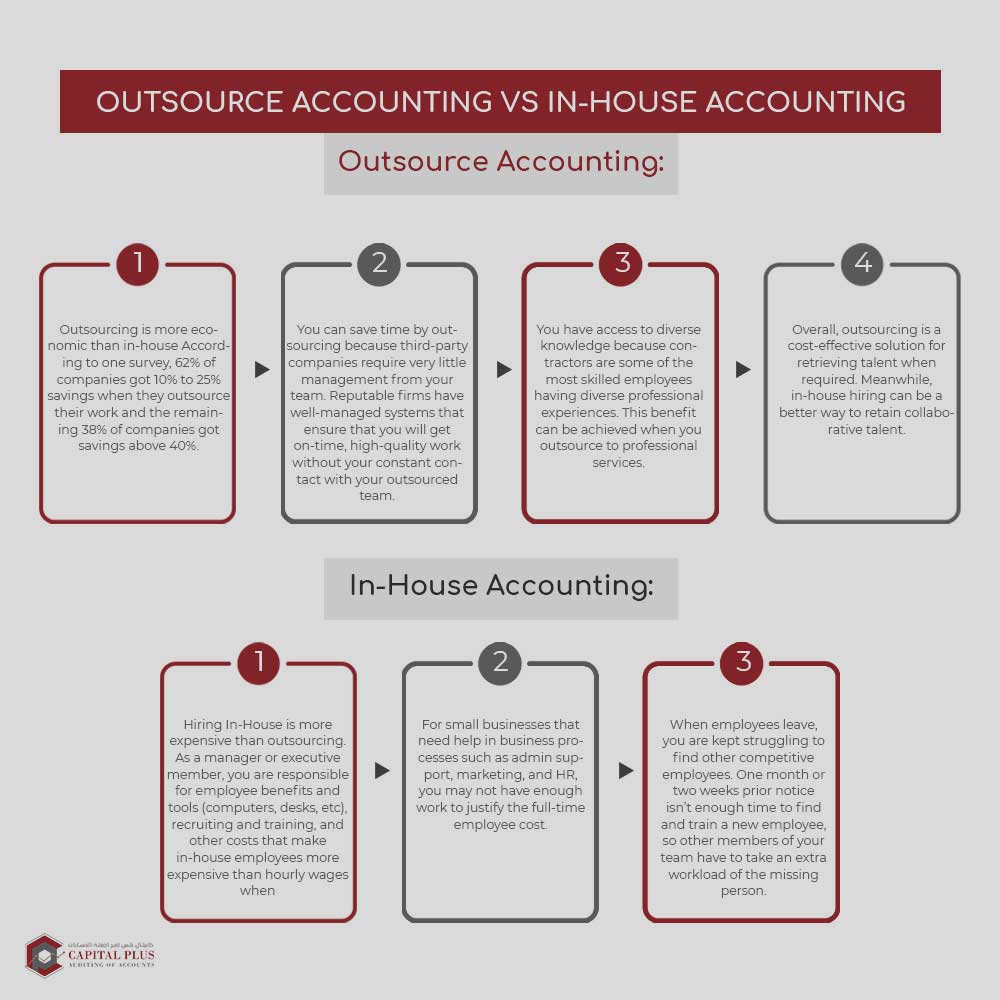

- Outsourcing is more economic than in-house According to one survey, 62% of companies got 10% to 25% savings when they outsource their work and the remaining 38% of companies got savings above 40%.

- You can save time by outsourcing because third-party companies require very little management from your team. Reputable firms have well-managed systems that ensure that you will get on-time, high-quality work without your constant contact with your outsourced team.

- It is easy to change the support level that you’re paying for, as your needs fluctuate. It enhances quality assurance and cost-effectiveness during your slow and busy periods since you’re not overworking a fixed team of employees.

- You have access to diverse knowledge because contractors are some of the most skilled employees having diverse professional experiences. This benefit can be achieved when you outsource to professional services.

- Overall, outsourcing is a cost-effective solution for retrieving talent when required. Meanwhile, in-house hiring can be a better way to retain collaborative talent.

Cons of Hiring In-House Vs Outsourcing

Besides the benefits of hiring in-house and outsourcing, there are certain drawbacks to each as well. You need to consider these factors when choosing which option is better for you.

Cons of Hiring In-House

- Hiring In-House is more expensive than outsourcing. As a manager or executive member, you are responsible for employee benefits and tools (computers, desks, etc), recruiting and training, and other costs that make in-house employees more expensive than hourly wages when

- For small businesses that need help in business processes such as admin support, marketing, and HR, you may not have enough work to justify the full-time employee cost.

- When employees leave, you are kept struggling to find other competitive employees. One month or two weeks prior notice isn’t enough time to find and train a new employee, so other members of your team have to take an extra workload of the missing person.

- Outsourced employees are often not included in your company’s main communication which can lead to important information not being shared with them and a general gap between them and other team members in your company.

- Language and Culture differences may cause miscommunications if you outsource your work to other countries. This occasionally happens if your in-house and outsourced team does not have a strong familiarity with the other’s culture.

- Outsourcing key jobs of your business can be risky because, if an employee you’re dependent on is no longer able or willing to generate the same output, then you can face a challenging situation. To reduce this risk, work with established and professional companies as compared to independent contractors.

- You need to calculate the costs against the communication challenges that may come with outsourcing your work.

How to Decide Whether You Should Outsource or Hire In–House

Ask yourself these questions when you are trying to decide whether you select Hire In-House vs outsourcing your business function or not:

1) Does the process directly relate to your business’s core activities?

- It helps you to make an environment where everyone is focused on work and achieving the same goals.

- It reduces the time that you spend on business functions that don’t generate revenue directly.

- It is a cost-effective way to enhance your team’s

2) Do you have the time to hire, train and manage additional employees?

Hiring and managing in-house employees needs an investment of significant time. Before hiring employees, consider your executive team has the time to manage additional employees.

Below are some signs by which you can measure that your business doesn’t have the capacity for additional employees:

- You do not have a manager who has sufficient knowledge and time to effectively guide employees about projects that fall outside of your core business.

- Your company is struggling to cope with your existing HR needs.

- It is challenging for you to find reasonable talent to utilize in non-core areas of your business.

- One of the biggest benefits of outsourcing your work to a professional services firm is that they will take full responsibility for finding, training, and managing the people who will work on your account. This helps your managers to focus on empowering your team.

3) What are the complete costs of outsourcing vs hiring in-house?

When you’re comparing the cost of outsourcing vs hiring in-house, hourly wages are often ambiguous because they are only one part of the total costs. You need to keep in mind the additional expenses including:

- Benefits

- Perks such as bonuses

- Taxes

- Materials (computer, desk, software, etc.)

- Management time

- Training

- Recruiting

Answering these three questions will help you in determining business functions which you should keep in-house and which you should outsource.