Running a business in the UAE is exciting, but many owners are now worried about new rules. One big fear is corporate tax. People are unsure if they must register, when to do it, and what will happen if they miss it. The solution is simple: understand the rules clearly and take action on time.

This guide answers the key question: Is Corporate Tax registration mandatory in UAE? We explain who must register, who is exempt, the penalties, and the easy steps to complete registration. Everything is written in simple words, so even beginners can follow. By the end, you will know exactly what to do to stay safe and avoid heavy fines.

Is Corporate Tax Registration Mandatory?

The short answer

Yes, Corporate Tax registration is mandatory in the UAE. The law applies to most businesses, whether they are on the mainland, in a Free Zone, or foreign companies with activities in the UAE. Even some individuals must register if their income is high enough.

What “mandatory” means

Mandatory means you do not have a choice. Every eligible business must register with the Federal Tax Authority (FTA) and get a Tax Registration Number (TRN). Without this number, you are not legally registered.

Exempt vs. registration

Even if you don’t need to pay Corporate Tax, you may still need to register. For example, Free Zone companies often qualify for a 0% rate, but they must still register to prove their status.

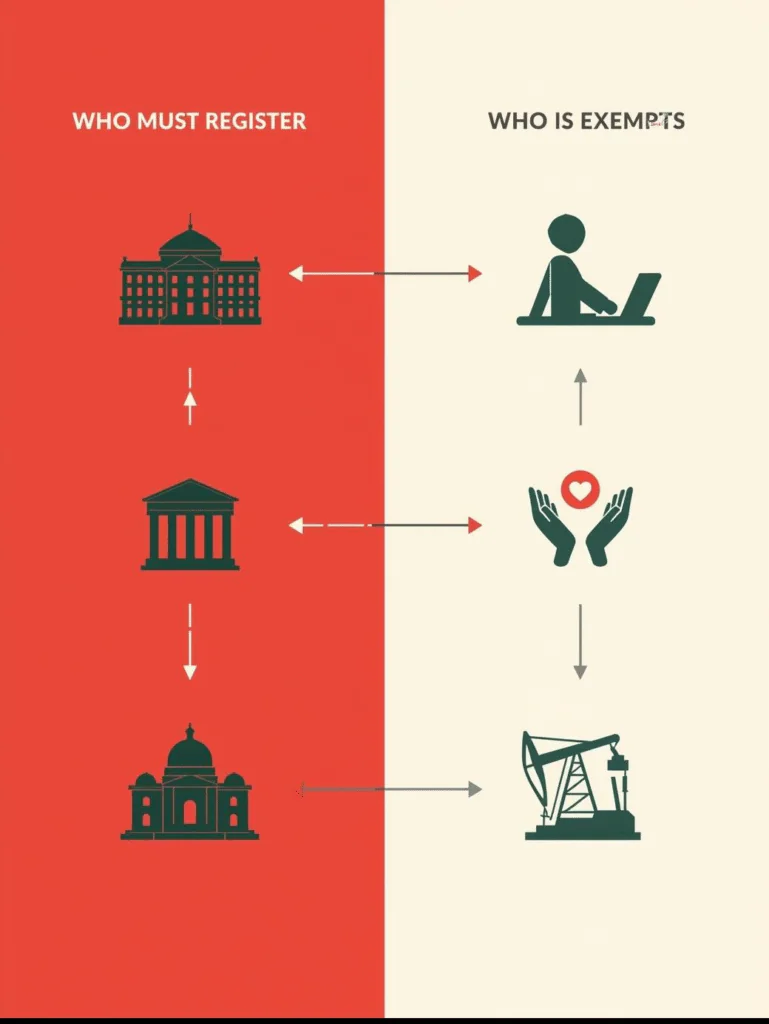

Who Must Register?

Corporate Tax registration is not only for big corporations. The rules apply to many businesses and even some individuals.

Mainland companies

All mainland businesses must register. This includes LLCs, PSCs, and foreign branches.

Example: A small bakery in Sharjah with an LLC licence must register, even if its profit is below AED 375,000.

Free Zone companies

Every Free Zone company must register. They may enjoy a 0% tax on certain income, but they must still register to prove it.

Example: An IT company in Dubai Internet City serving only foreign clients must register, even if its tax rate is 0%.

Non-resident entities

Foreign companies must register if they:

- Have a Permanent Establishment (PE) (office, branch, or staff in UAE).

- Have a Nexus (significant income from UAE).

Example: A UK firm with a sales branch in Abu Dhabi must register.

Individuals in business

People must register if their annual turnover from business activities is more than AED 1 million. This includes:

- Freelancers

- Consultants

- Online sellers

- Landlords with commercial properties

- Influencers/YouTubers with brand contracts

Example: A consultant earning AED 1.2m in a year must register.

Who is Exempt?

Government entities

All government ministries, federal bodies, and local authorities are exempt.

Example:

The Ministry of Education does not need to register or pay Corporate Tax.

Natural resource businesses

Companies that extract or exploit natural resources, like oil and gas, are exempt from federal Corporate Tax because they already pay Emirate-level taxes and royalties.

Example:

An oil exploration company in Abu Dhabi does not fall under Corporate Tax.

Public benefit organizations

Charities and non-profits may be exempt, but only if the UAE Cabinet approves them. These could include cultural, religious, or social welfare organizations.

Example:

A charity registered to support orphans may be exempt if it has Cabinet approval.

Non-resident entities without nexus

Foreign companies with no office, no staff, and no UAE income do not need to register.

Example:

A German company selling only in Europe with no UAE operations does not register.

Special cases

The FTA may sometimes ask exempt companies to register just for record-keeping, even if they don’t pay tax.

Combined checklist (Who must & Who is exempt)

Category | Register Required? | Tax Payable? | Notes |

Mainland companies | ✔️ Yes | ✔️ Yes | All LLCs, PSCs, branches |

Free Zone companies | ✔️ Yes | ✔️ / 0% | Register; 0% on qualifying, 9% on non-qualifying |

Non-resident entities (PE/Nexus) | ✔️ Yes | ✔️ Yes | Must register if linked to UAE |

Individuals (AED 1m+ turnover) | ✔️ Yes | ✔️ Yes | Freelancers, consultants, creators |

Government entities | ❌ No | ❌ No | Exempt, part of the state |

Natural resource businesses | ❌ No | ❌ No | Already taxed at Emirate level |

Public benefit organizations | ❗ Maybe | ❌ No | Cabinet approval needed, may still register |

Non-residents without nexus | ❌ No | ❌ No | No UAE branch, no UAE income |

Special cases (FTA request) | ✔️ Yes | ❌ No | May register to confirm exemption |

Free Zone Companies

Free Zones Companies are popular because of benefits like 100% foreign ownership and, in some cases, 0% Corporate Tax. But Free Zone businesses must still register.

Why registration is required ?

Registration confirms your company qualifies for the Free Zone benefits. Without it, you lose your right to 0% treatment.

Qualifying vs. non-qualifying income

- Qualifying income (0%) → Usually from exports or Free Zone-to-Free Zone business.

- Non-qualifying income (9%) → Income from the UAE mainland or income that doesn’t meet qualifying rules.

Example 1: An IT company serving only Europe → 0% tax but must register.

Example 2: A trading firm selling into Dubai → Mainland sales taxed at 9%.

Risks of skipping registration

- Losing Free Zone tax benefits

- AED 10,000 fines

Delayed licence renewal

Penalties for Late or Missed Registration

The UAE has zero tolerance for late registration.

AED 10,000 fine

If you miss the deadline, you face a AED 10,000 fine—no exceptions.

Example: A Free Zone company due 31 May but applying on 2 June pays AED 10,000.

Other risks

- Trouble renewing trade licence

- Banking difficulties (many banks require TRN)

- Lost contracts with government or corporates

Temporary waiver (2025)

A one-time waiver exists for 2025. If you register late but file your first tax return and declaration within seven months of your first tax period, you may avoid the fine. This is temporary and may not continue.

Why early registration is better

Applying early avoids stress, mistakes, and last-minute issues.

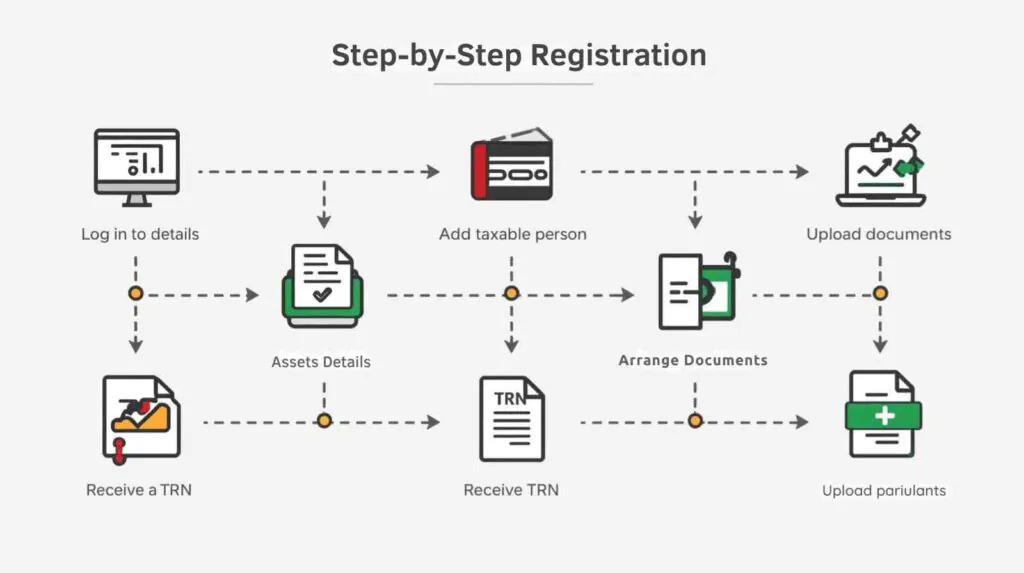

Step-by-Step Registration

Step 1: Create or Log In

Start by logging into the EmaraTax portal using your UAE PASS. For smooth processing, consider expert support from Capital Plus Auditing to guide you through each step.

Step 2: Add the Taxable Person

Select whether you are registering as an individual or a company.

Step 3: Enter Business Information

Provide accurate details, including:

- Trade licence number and a scanned copy

- Registered company name and business activity

- Legal structure (LLC, PSC, branch, etc.)

- Contact details and office address

Step 4: Upload Required Documents

Attach the following documents in clear, legible scans:

- Valid trade licence

- Memorandum of Association (MoA)

- Passport and Emirates ID copies of owners/authorized signatories

- Proof of authority if applying on behalf of a company

Step 5: Submit Your Application

Review all entered details carefully before submitting. Even small errors can delay approval.

Step 6: Receive Your TRN

Once approved, the Federal Tax Authority (FTA) issues your official Tax Registration Number (TRN), confirming successful registration.

Common Mistakes to Avoid

- Submitting applications with expired trade licences

- Uploading poor quality or unclear scans

- Making spelling or typing errors in company names

- Leaving registration until the last minute, risking delays and fines

Would you like me to also convert this into a clean infographic outline so you can use it as one of your blog visuals (like “Step 1–6 with icons”)?

Tools & Resources

The Federal Tax Authority (FTA) offers several tools and resources to make corporate tax registration straightforward, while businesses can also rely on professional guidance from Capital Plus Auditing to avoid mistakes and delays. All registrations are completed online through the EmaraTax portal, which serves as the official platform for submitting applications.

Before starting the process, businesses should ensure they have all required documents ready. This includes a valid trade licence, the Memorandum of Association (MoA), Emirates ID and passport copies of owners or partners, updated contact details, and proof of authority if someone is applying on behalf of the company. Preparing these documents in advance helps prevent rejections and unnecessary delays.

To further assist applicants, the FTA provides a range of support materials such as manuals, detailed guides, and video tutorials that explain every step of the process. In case additional help is needed, businesses can contact the toll-free FTA helpline, use the email support option within the portal, or refer to the comprehensive online FAQs for quick answers.

Conclusion

Corporate Tax registration in the UAE is mandatory. Whether you are a mainland business, Free Zone company, or an individual earning more than AED 1 million, you must register. The process is simple, but missing it can lead to a heavy fine, licence renewal issues, and banking delays.

At Capital Plus Auditing, we help businesses and individuals register quickly and correctly. Our team ensures all documents are prepared and submitted on time so you avoid penalties and stay compliant.

If you are still confused, don’t risk fines. Contact Capital Plus Auditing today to complete your Corporate Tax registration and stay 100% compliant with UAE law.

FAQs

Yes. If you hold a valid trade licence, you must register, even if there’s no business activity.

Yes, if yearly income is more than AED 1m. If it’s below AED 1m, no registration is required.

Yes. VAT and Corporate Tax are separate, with different TRNs.

No. VAT TRN and Corporate Tax TRN are separate.