What is the Deadline for Corporate Tax Registration in UAE

Running a business in the UAE is exciting, but it also comes with responsibilities. One of the biggest challenges business owners face is staying updated with government deadlines. Missing important dates, like corporate tax registration, can lead to stress, fines, and even damage to your company’s reputation. The good news is that if you know the deadlines clearly, you can avoid all of these problems with ease.

This article will explain the deadline for corporate tax registration in UAE, including the updated rules for 2025. We will also cover the difference between registration and filing deadlines, penalties for delays, and tips to help you stay compliant. By the end, you will have a clear roadmap to avoid penalties and keep your business safe.

Understanding Corporate Tax Registration in UAE

Corporate tax registration in the UAE is the process where businesses officially inform the Federal Tax Authority (FTA) that they are earning income and will pay tax according to the rules. It is not optional; every company and eligible freelancer must register once they meet the required criteria.

In simple words, it is like telling the government, “Yes, I am running a business, and I am ready to pay corporate tax on my profits.” Once registered, the business will receive a Tax Registration Number (TRN), which is used for filing corporate tax returns each year.

Who needs to register?

- Companies registered in the UAE

- Branches of foreign companies operating in the UAE

- Freelancers and sole proprietors who earn more than AED 1 million in a year

- Non-resident companies that earn income from the UAE

The UAE has introduced corporate tax to align with global standards, but at the same time, the rate of 9% is one of the lowest in the world, making it business-friendly. Still, deadlines are taken very seriously.

Deadline for Corporate Tax Registration in UAE 2025

The deadline for corporate tax registration in UAE 2025 is a key date every business owner must keep in mind. The Federal Tax Authority has announced that companies must register within the timelines provided, depending on when their business license was issued.

For example:

- Businesses with older licenses (issued before March 2024) have specific deadlines based on the month their license was issued.

- Newly established businesses (after March 2024) must register within three months of incorporation.

If you delay, the FTA may impose fines starting from AED 10,000. This is why it is important to check your license date and register before your specific deadline.

For business owners planning ahead, 2025 is the year when enforcement becomes stricter. Authorities expect every eligible business to be registered and ready for filing returns.

Corporate Tax Filing Deadline 2025

There is a difference between registration deadline and filing deadline.

- Registration deadline: When you must register your business with the FTA and get your TRN.

- Filing deadline: When you must submit your annual corporate tax return, showing your income, expenses, and profits for the year.

The corporate tax filing deadline 2025 will usually be nine months after the end of your financial year. For example, if your financial year ends on December 31, 2024, your first tax return will be due by September 30, 2025.

This means businesses must not only register but also prepare their accounts early to meet filing requirements. Failing to submit on time can lead to penalties just like missing the registration deadline.

Deadlines Based on Business Type

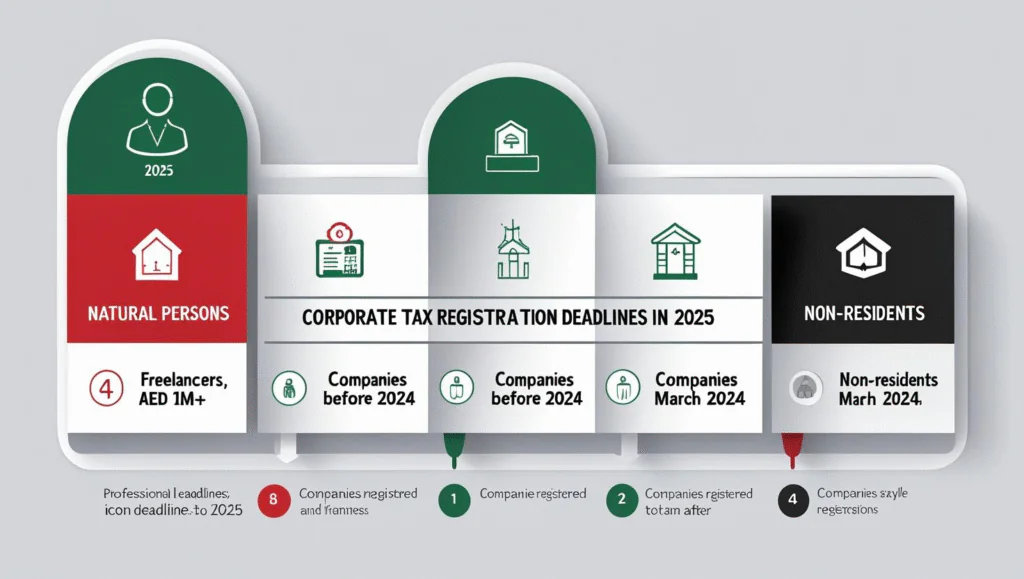

Not every business has the same deadline. The FTA has set different timelines depending on the type of entity.

Freelancers and Individuals

- If your income from business activities is less than AED 1 million, you don’t need to register.

- If your income is AED 1 million or more in a year, you must register within three months of crossing the threshold.

Companies Incorporated Before March 2024

- These companies must register based on their license issuance month. For example, if your license was issued in January, you may have a different deadline than someone whose license was issued in July.

Companies Incorporated After March 2024

- Newly formed companies must register within three months of incorporation.

Non-Resident Companies

- For Non Resident Companies, If a foreign company earns income in the UAE, it must register once it has a permanent establishment or source of income in the country.

By dividing deadlines this way, the FTA makes sure every business is included and no one slips through the cracks.

Penalties for Missing Corporate Tax Registration Deadlines

The UAE takes compliance seriously. If you miss the corporate tax registration deadline, you may face heavy fines.

Some of the penalties include:

- AED 10,000 fine for late registration

- Additional penalties if tax returns are not filed on time

- Possible audits or restrictions on business activities

- Negative impact on your company’s reputation and credibility

These penalties can be a big burden, especially for small businesses or freelancers. That is why registering and filing on time is the safest option.

How to Prepare for Corporate Tax Registration and Filing

Preparation is the key to meeting deadlines without stress. Here are simple steps every business owner should follow:

- Gather Documents Early

- Trade license copy

- Passport and Emirates ID of owners

- Company incorporation document

- Financial statements

- Keep Accounting Records Updated

- Track income and expenses properly

- Use accounting software if possible

- Hire a professional bookkeeper if needed

- Use Professional Support

- Tax advisors can guide you on complex cases

- Consultants can register your business quickly with the FTA

By being ready in advance, you save time and avoid the last-minute rush.

Tips for Business Owners to Stay Compliant

Staying compliant is not just about registration, it is about building habits that keep your business safe.

- Mark Deadlines on a Calendar: Note the registration and filing dates in your company’s calendar.

- Use Digital Reminders: Set reminders in your phone or accounting software.

- Check FTA Updates Regularly: Rules and deadlines may change, so stay informed.

- Train Your Team: If you have employees handling accounts, make sure they understand the importance of deadlines.

Small steps like these can make a big difference and save you from costly penalties.

Conclusion

The deadline for corporate tax registration in UAE is one of the most important dates for every business owner. Missing it can mean fines, stress, and legal issues, while registering on time gives you peace of mind and keeps your business reputation strong.

As 2025 approaches, businesses should not only register but also prepare for filing their first tax returns. Whether you are a freelancer, a small company, or a large enterprise, compliance is the key to smooth business operations in the UAE.

If you are unsure about your deadline or need help with corporate tax registration, consult a professional advisor today. Taking action now will save you from penalties later and give you the confidence to focus on growing your business.

To get rid of doing this process manually, you can contact Capital Plus Auditing for better experience.

Frequently Asked Questions

You may face a fine of AED 10,000 and additional penalties for late filing.

No. It depends on when your company was incorporated and your business type.

It is nine months after the end of your financial year. For most companies, this will be September 30, 2025.

Yes, if their annual business income is AED 1 million or more.

You can log into the FTA portal and verify your registration status online.