Running a business in the UAE has always been attractive because of its tax-friendly environment. For many years, companies enjoyed zero corporate tax. But from 2023, things changed when the UAE introduced corporate tax for the first time. Now, every business owner, freelancer, or foreign company with UAE income is asking the same question: how do I handle this new system? The biggest challenge people face is confusion. They do not know if they need to register, when the deadline is, or what documents are required. Missing the process can lead to heavy penalties.

The good news is that corporate tax registration UAE is not as complicated as it looks. With the Federal Tax Authority’s EmaraTax platform, registration can be done online in a few simple steps. This guide explains the meaning of corporate tax registration, who must register, the deadlines in 2025, documents required, and a step by step process. Whether you are a large company, a small business owner, or a freelancer, this blog will give you clarity and confidence to register on time and avoid fines.

What is Corporate Tax Registration

Corporate tax registration means officially informing the Federal Tax Authority (FTA) that your business is covered under the UAE’s new corporate tax law. When you register, the FTA gives you a Corporate Tax Registration Number (TRN), which is unique to your business. This TRN is used every time you file a corporate tax return or communicate with the authority.

The purpose of registration is simple:

- It ensures that all companies and individuals above the threshold are included in the tax system.

- It allows the government to track compliance and tax collection.

- It gives businesses an official identity for tax purposes.

Registration is important because without it, you cannot file corporate tax returns. If you fail to register before the deadline, you may face penalties starting from AED 10,000.

Why corporate tax registration matters in 2025

In 2025, deadlines are now active for both companies and individuals. Many businesses that started before 2024 were given staggered deadlines, and now these deadlines are catching up. Freelancers who earned more than AED 1 million in 2024 must also register by March 2025. Delaying registration not only risks penalties but also creates unnecessary stress when filing returns later.

Key highlights of UAE Corporate Tax Law

- Tax rates: 0 percent on taxable income up to AED 375,000, and 9 percent on income above that.

- Free zones: Certain free zone companies may qualify for a 0 percent rate on qualifying income, but they must still register.

- Individuals: Freelancers and self-employed people with income above AED 1 million must register.

- Non-residents: Foreign companies with a permanent establishment in the UAE must register.

Who Must Register for Corporate Tax in UAE

The UAE law clearly explains who needs to register:

- Resident companies and legal entities

All companies incorporated in the UAE, whether in the mainland or a free zone, must register. Even if a company is not yet profitable, registration is still required. For example, a start-up with zero profit must register if it holds a trade licence. - Non-resident entities with UAE operations

If a foreign company has a branch office, factory, or fixed place of business in the UAE, it is considered to have a permanent establishment. Such companies must register and pay tax on UAE-sourced income. - Natural persons and freelancers above the threshold

Any individual earning more than AED 1 million per year from business activities (like consultancy, freelancing, or e-commerce) must register. For instance, a freelancer who earned AED 1.2 million in 2024 must register before 31 March 2025.

Corporate Tax Registration Deadlines in UAE 2025

Deadlines are one of the most important points because missing them leads to fines.

- Deadlines for natural persons

Freelancers or individuals who earned over AED 1 million in 2024 must register by 31 March 2025. From 2026 onwards, individuals will have until 31 March of the following year to register if they cross the threshold. - Deadlines for companies incorporated before March 2024

Older companies had staggered deadlines based on the month their trade licence was issued. For example, if your licence was issued in January, your deadline may have been mid-2024. If you missed it, you must register immediately to avoid penalties. - Deadlines for companies incorporated after March 2024

Any new company established on or after 1 March 2024 must register within three months of incorporation. For example, a company incorporated in July 2024 must register by October 2024. - Non-resident registration timelines

Non-residents must register as soon as they establish a permanent presence in the UAE. This could be a branch, office, or even a fixed project site.

Documents Required for Corporate Tax Registration UAE

Before starting registration, gather these documents:

- Identification and trade licence documents

- Valid trade licence

- Passport copy of the authorised signatory

- Emirates ID of the owner or manager

- Ownership and legal structure documents

- Memorandum of Association (MOA)

- Shareholder certificates

- Partnership agreements, if applicable

- Banking and financial information

- IBAN number of company bank account

- Start and end date of financial year

- Contact information, including email and phone

Tip: Make sure the details on the trade licence, ID, and bank account match exactly. Even small errors can delay the application.

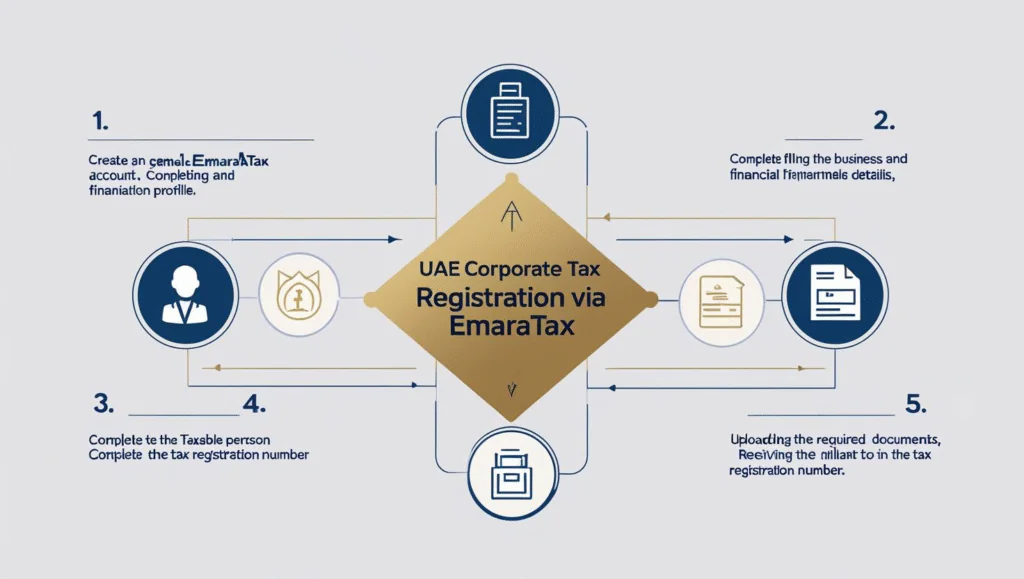

Step by Step Corporate Tax Registration UAE Process

The process is online and user-friendly. Here is the step by step guide using EmaraTax:

- Create or log in to EmaraTax account

Visit the FTA website and sign in. If you already registered for VAT, you can use the same account. - Complete the taxable person profile

Select whether you are registering as a company, a free zone entity, or an individual. - Fill in business and financial year details

Enter your legal name, trade licence number, activity type, and financial year (for example, Jan–Dec). - Upload documents and submit application

Attach scanned copies of your trade licence, passport, Emirates ID, and other documents. - Receive corporate tax registration number

Once approved, you will receive your TRN. This confirms you are officially registered.

Most applications are processed within a few working days if the documents are correct.You can see a guide on Corporate Text Registration on Capital Plus Auditing, Visit now ans explore.

What to Do After Corporate Tax Registration

Registration is only the beginning. After you get your TRN, you must prepare for compliance:

- Set up accounting records and compliance systems

Keep a chart of accounts, issue invoices properly, and record all expenses and income. - Maintain beneficial owner information

Keep updated details of the ultimate owners and controllers of the company.

Grant access to accountants or tax agents

Authorised tax agents can file returns on your behalf, but they need access to your EmaraTax account.

Corporate Tax Return UAE Filing and Payment

Every registered business must file a corporate tax return once a year.

- When to file the return

The return is due within nine months after the end of your financial year. - Example of the nine month deadline

If your financial year ends on 31 December 2024, you must file by 30 September 2025. If your financial year ends on 31 March 2025, you must file by 31 December 2025. - Key information included in the return

Financial statements, taxable income, deductions, and the final tax payable.

Payment of tax is also due by the same date as the return.

Free Zone Companies and Corporate Tax Registration UAE

Even if you are based in a free zone, you must register.

- Eligibility for free zone benefits

Certain income earned by free zone companies is taxed at 0 percent if they qualify as a Qualifying Free Zone Person (QFZP). - Conditions to qualify

- Have a substantial presence in the UAE (real office, staff, etc.)

- Earn qualifying income as defined by the FTA

- Comply with transfer pricing rules

- Risks of losing benefits

If you fail to meet the conditions, your company will be taxed at 9 percent like mainland businesses.

Small Business Relief and Exemptions under UAE Corporate Tax

The law gives relief to small businesses and exemptions in special cases.

- Small business relief

Companies with annual revenue below AED 3 million in certain tax years can claim relief, meaning they pay no tax. - Exemptions under the law

- Government bodies

- Extractive industries (like oil and gas, if paying royalties)

- Charities and non-profits approved by the government

- Example of relief

A small marketing agency with AED 2.5 million annual turnover can claim small business relief and pay zero tax, though they must still file a return.

Penalties for Late Corporate Tax Registration UAE

The FTA enforces penalties to ensure compliance.

- Missing registration deadlines

A fine of at least AED 10,000 applies if you do not register on time. - Late filing of returns

Additional penalties are charged if you submit your corporate tax return late or fail to pay tax on time. - 2025 waiver initiative

In 2025, the FTA announced some limited penalty waivers for businesses that quickly corrected their delays. However, relying on waivers is risky. The safest way is to register and file early.

Conclusion

Corporate tax registration in UAE may feel complicated at first, but once you understand the process, it becomes straightforward. The government has introduced corporate tax to align with international standards while still keeping the UAE one of the most business-friendly countries in the world. By registering on time, keeping your documents ready, and following FTA guidelines, you can avoid penalties and stay fully compliant.

If you are unsure about the process or want to save time, it’s always best to seek professional assistance. Expert tax advisors can guide you step by step, ensure accurate filing, and help you benefit from available exemptions. Begin your corporate tax registration in UAE today with Capital Plus Audit and keep your business safe, compliant, and future-ready.