In this article, we will discuss the Business Liquidation process, the major 6 Benefits of liquidation, and the Liquidation process in the UAE.

What is liquidation?

Business Liquidation, dissolution, or de-registration is when a company is voluntary or involuntary declared insolvent, which means winding up all the financial matters of a company and selling off the business’s assets to repay its debts. It can be an exit strategy for a business or company that is no longer profitable.

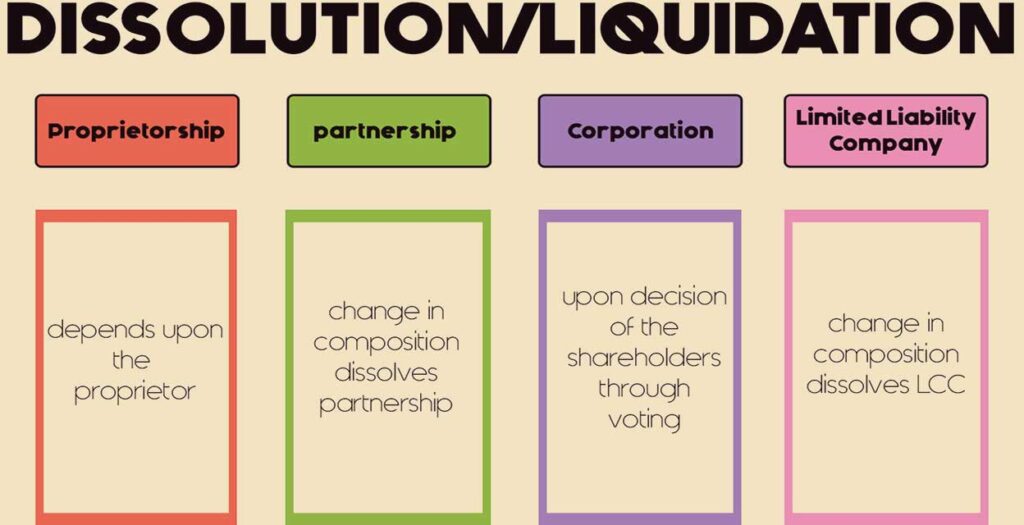

The liquidation process applies only to companies or the business under a company structure.

Bankruptcy is a different concept that is sometimes confusing with liquidation. It is only applied to individuals, including partners in partnerships and sole traders.

Business Liquidation is different from selling a business, it only involves a change of ownership. Once a liquidation process for a company is completed, then company operations are permanently ceased and it is completely dissolved.

Liquidation Process in UAE

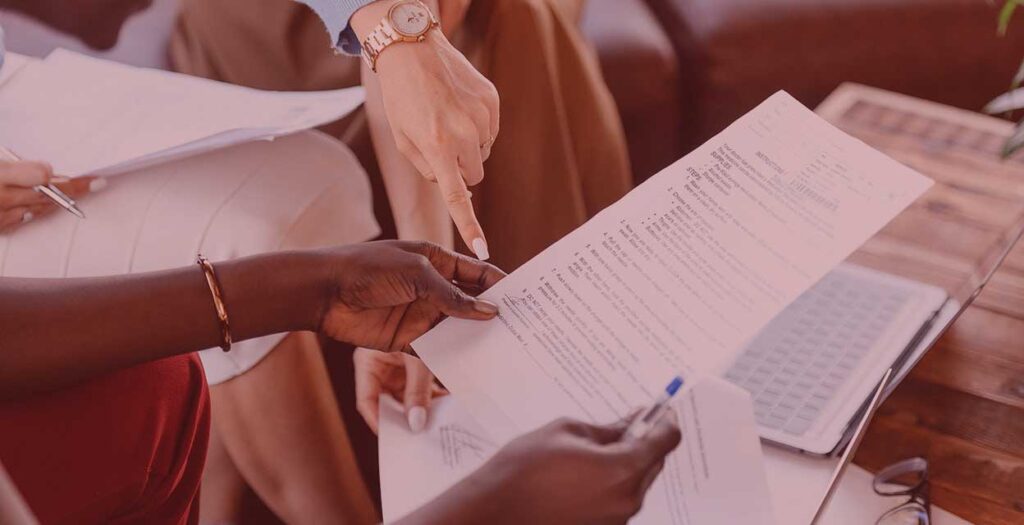

The liquidation process is the detailed legal procedure, in which land regulation is taken place to ensure all shareholders are being considered at the time of dismantling the company in UAE.

The liquidation process involves a court order, after an application by a creditor, the majority of shareholders or directors can also apply to the court. During the liquidation process, unsecured creditors cannot start legal action unless they have permission from a court. The company’s bank accounts are frozen and Directors have no longer authorized

The Liquidation process of the Limited Liability Company (LLC) in the UAE

Dissolving an LLC Company in UAE involves the following major steps:

1. BOD Meeting:

Board of directors of the declared to liquidate the appointment of regulated liquidator and company during minutes of a meeting. This document should be attested and verified by Notary Public.

2. Official letter from liquidator:

The registered liquidator must have a confirmation letter stating to accept the responsibility to liquidate the company.

3. Application for liquidation:

To get the company liquidation certificate Submission of the liquidation form is mandatory with fees to be submitted to the Department of Economic Development.

4. Advertisement in the newspaper:

The next step is to place an advertisement in a local Arabic newspaper to announce the termination of a company.

5. Notice period:

DED issues 45 days grace period to wait for the clients or creditors if they have any financial claims on the company.

6. Final Liquidator’s report:

During the 45 days ad period, the liquidator will then submit the final company audit report and a letter stating that there is no claim from the third party/Creditors/Client.

7. Visa Cancellation:

Cancel visa of all partners and employees and take NOC from the Ministry of Immigration, Ministry of Labor, DEWA & Etisalat/Du.

8. Final Liquidation Certificate:

After the submission of all the documents, DED will issue a final company liquidation Certificate.

The Liquidation process of the Free Zone Company (FZE) in the UAE

Every free zone has a different procedure to follow for company liquidation. Below are the most common procedures of liquidating a Free Zone Company in the UAE:

1. BOD Meeting:

The Board of directors declares to liquidate the company and appointment of a regulated liquidator in minutes of a meeting. This document should be verified and attested by Notary Public.

2. Official letter from liquidator:

The registered liquidator must have a confirmation letter stating to accept the responsibility to liquidate the company.

3. Application for liquidation:

To get the company liquidation certificate Submission of the liquidation form is mandatory with fees to be submitted to the Department of Economic Development.

4. Advertisement in the newspaper:

The next step is to place an advertisement in a local Arabic newspaper to announce the termination of a company.

5. Notice period:

DED issues 45 days grace period to wait for the clients or creditors if they have any financial claims on the company.

6. Final Liquidator’s report:

During the 45 days ad period, the liquidator will then submit the final company audit report and a letter stating that there is no claim from the third party/Creditors/Client.

7. Visa Cancellation:

Cancel visa of all partners and employees and take NOC from the Ministry of Immigration, Ministry of Labor, DEWA & Etisalat/Du.

8. Final Liquidation Certificate:

After the submission of all the documents, Free Zone Authority will issue a final company liquidation Certificate.

Why choose liquidation?

Liquidation is the only way to tail off operations and close a business in an orderly way. It makes sure assets are distributed among creditors and stakeholders. It also helps to minimize the impact of insolvent trading. It also provides creditors, shareholders, and directors the opportunity to have an independent investigation and manage the liquidation.

So the most important and major reasons include lower costs, control, and freedom from the stress of insolvent trading.

What are the Advantages of Liquidation?

Liquidation is a very useful way of closing a limited company that is no longer able to trade because of its debts. It is normally not used where the company is solvent, or when the business in the limited company can be restructured, administration or a CVA is usually a better option if this is the case.

- If the business is under immense pressure from creditors, the business can be closed and all creditors will be dealt with by the appointed practitioner.

- It closes the matter of insolvent businesses struggling to cope, in a legal and organized manner.

- It removes the responsibility from the business owners and directors of the company or organization.

- You do not need to file annual accounts, tax returns, or VAT accounts, once the liquidation process has been completed.

- Employees and workers will be able to claim any unpaid salary, notice pay, holiday pay, and redundancy from the government fund. However, this is applied to some limits.

- Any debt recovery pressure or county court judgments will be removed, not including any personal debts of the directors.

- The directors and employees can find other employment or start another business.

- The directors having the responsibility to deal with creditors can be removed, although the creditors will be unaffected who have been guaranteed personally.

- Customs and HM Revenue will no longer chase the directors for VAT or PAYE.

- Hire purchase agreements and terms on lease are generally aborted at the date of liquidating the company, meaning that there is no further payment need to be paid.